Our Approach

Moving Beyond the Old 60/40 Portfolio

For nearly 70 years, the 60/40 model (60% stocks, 40% bonds) has been the standard. But today In lower inflationary and growth environments, we've seen positive correlations diminish somewhat over the last year, but not yet going to negative territory. So therefore, a traditional 60/40 allocation is no longer able to provide the expected risk or return profile, so investors must always have other assets for diversification.

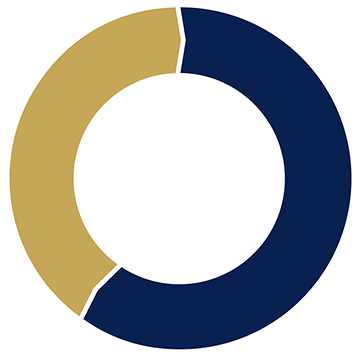

Meet the 40/40/20 Model

Our recommended 40/40/20 asset mix includes:

- 40% Traditional Equities

- 40% Fixed Income Alternatives

- 20% Private Assets (Private Equity, Private Real Estate, and Private Credit)

This diversified approach has historically provided stability with returns similar to public equities—while helping to reduce risk. By including factoring, real estate, and mortgage investment corporations, the 40/40/20 mix aims to balance growth and resilience for the modern investor.

The New Way to Invest

Expand Beyond Traditional Markets

Most investors think of the stock market when it comes to growing wealth. While publicly traded stocks are common, institutional investors—like pension funds, endowments, and ultra-high-net-worth individuals—have long relied on diversified portfolios that include alternative investments. Now, Green Private Wealth brings these powerful investment options to you.

A Fresh Approach to Investing

Modern Strategies for Today's Investor

At Green Private Wealth, we believe in an investment approach that’s as unique as your goals. Gone are the days of cookie-cutter strategies. Our New Way to Invest is rooted in innovation, tailored to align with what matters most to you and your lifestyle.

Why Not Invest

Like the Best?

Alternative investments have been a staple in large institutional portfolios, helping to manage risk and boost returns. So, if these assets are essential for pensions, endowments, and high-net-worth portfolios, why shouldn’t they be part of yours? With exclusive access to private equity, private debt, and private real estate, Green Private Wealth makes it possible for all investors to benefit from these sophisticated options, regardless of accreditation status.

Allocation to Alternative Investment

Ontario Teachers Pension (OTTP) (69%)

Ontario Municipal Employees Retirement Scheme (OMERS) (62%)

US Endowments (52%)

Canada Pension Plan (CPPIB) (50%)

Ultra High Net Worth (46%)

High Net Worth (22%)

Retail Investors (5%)

Annual reports for each pension plan (OTPP, OMERS, CPPIB), average for endowments, Tiger 21. Dec 31, 2021

Ready to Take Your Portfolio to the Next Level?

Let Green Private Wealth guide you in leveraging these alternative investments to achieve your financial goals.

Connect with us today

and explore how a modernized investment strategy can empower your future.

About Us

Green Private Wealth is a discretionary wealth management team focused on helping investors achieve their goals using discretionary portfolio management, financial planning and tax integration. We have evolved to meet the needs of our clients and stay at the forefront of the rapidly changing wealth management landscape. Using innovative strategies in private credit, private real estate and private equity, we offer true pension style portfolio management. We believe this approach offers a more stable way to gain wealth and helps our clients avoid the volatility associated with traditional stock and bond only portfolios. We believe that, through sound planning, there is always a better way to manage risk and help your investments grow.

Copyright by Green Private Wealth of Harbourfront Wealth Management Inc. All Rights Reserved. No portion of this site may be replicated without permission. Harbourfront Wealth Management Inc is a member of the Canadian Investor Protection Fund and the Investment Regulatory Organization of Canada. Green Private Wealth is a personal trade name of Paul Green.