Future-Ready Retirement Planning

Guiding you Through Life's Financial Transitions

At Green Private Wealth, we recognize that life changes often bring important financial decisions. During these times, having a trusted advisor who aligns your wealth with your life goals is essential. Our team provides a modern approach to financial planning, using customized, disciplined strategies that evolve with you.

The Wealth

Evolution Solution

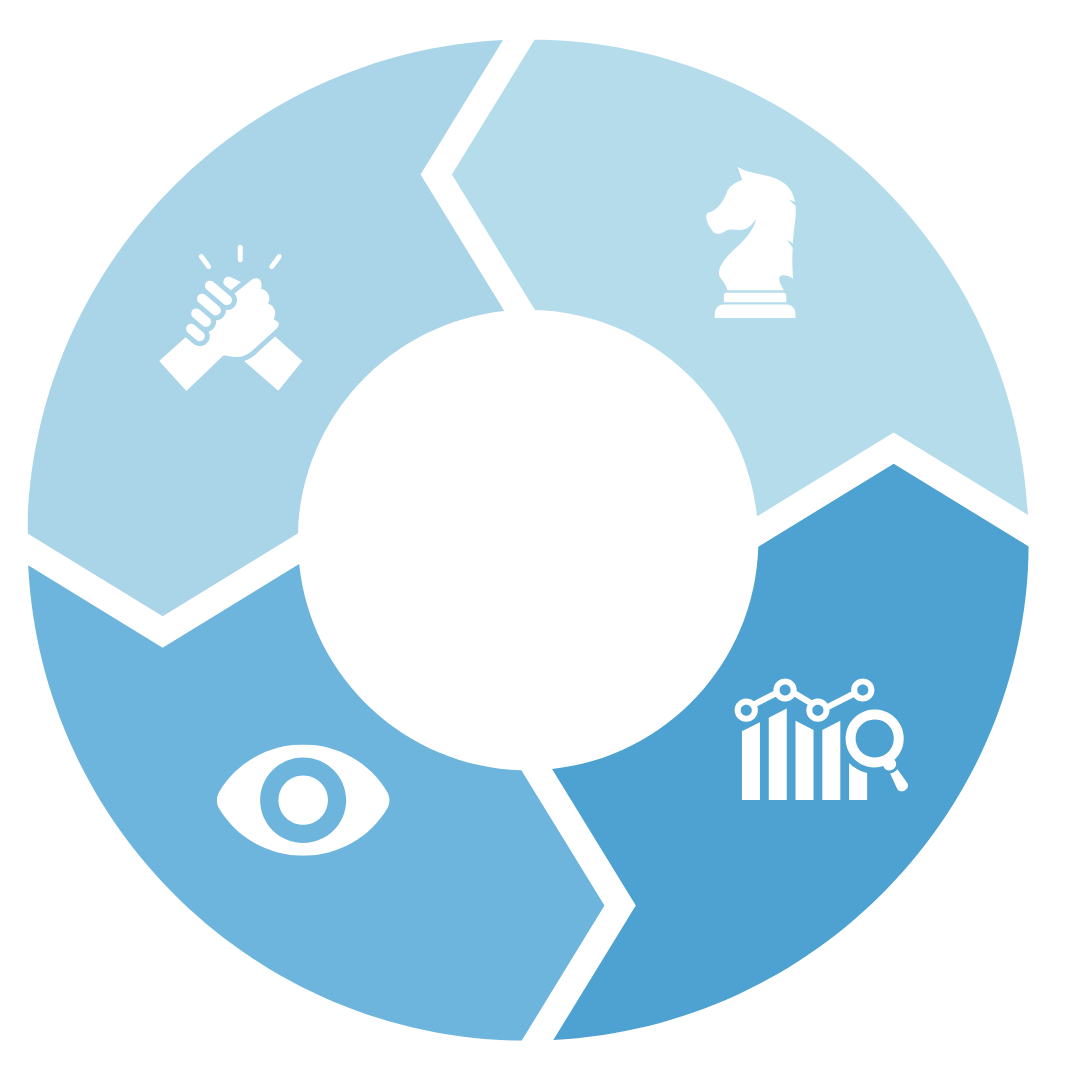

The Wealth Evolution Solution (WES) helps clients gain clarity and confidence in achieving their financial and life goals during transitions. It begins with analyzing your current situation, developing an investment strategy that protects your wealth, minimizes risk, lowers your tax burden and increases net worth, year after year. Here’s how it works:

Personalized Analysis

We start by thoroughly assessing your current financial situation to identify the best strategies for your needs.

Customized Investment Strategy

Your plan is tailored to protect your wealth, reduce risks, and minimize taxes—all while building your net worth year after year.

Ongoing Support and Adjustments

As life evolves, so do our strategies, ensuring your financial plan always aligns with your goals.

Gain Financial Clarity and Confidence with WES

Discover how the Wealth Evolution Solution can support your journey. Connect with us today to start making empowered financial decisions.

Our Unique Process

Get A Call For -

A Free Consultation!

Request a call for a free consultation on Financial Planning, Life and Health Insurance, Tax Planning or a Pension Commuted Value Analysis.

Copyright by Green Private Wealth of Harbourfront Wealth Management Inc. All Rights Reserved. No portion of this site may be replicated without permission. Harbourfront Wealth Management Inc is a member of the Canadian Investor Protection Fund and the Investment Regulatory Organization of Canada. Green Private Wealth is a personal trade name of Paul Green.