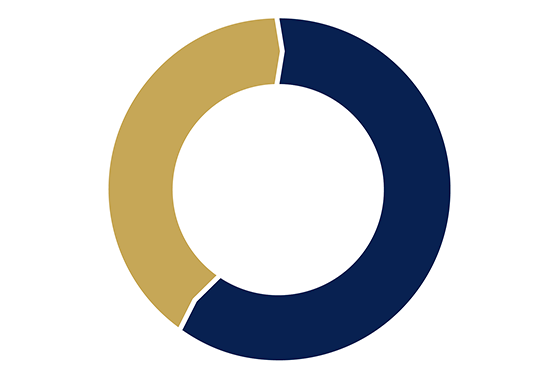

Goodbye 60/40

Times have changed and so should your portfolio. The 60/40 balanced portfolio was introduced nearly 70 years ago. With inflation at 30 year highs and interest rates increasing, it is going to be difficult to achieve the same returns you have in the past going forward and this has created headwinds for the investment community. You simply can't use the same tool you have been using to get the job done when the investment environment has changed.